Learn the key mistakes to avoid when investing in cryptocurrencies and discover the best strategies for maximizing your returns. Our expert guide breaks down everything you need to know to make smart, informed investments and avoid costly pitfalls.

Introduction

Cryptocurrencies have exploded in popularity over the past few years, with investors around the world looking to take advantage of the potential for high returns. However, investing in cryptocurrencies can also be risky, and there are many common pitfalls that investors should be aware of in order to maximize their chances of success. In this blog post, we'll explore some of the most common mistakes that investors make when investing in cryptocurrencies and offer tips and strategies for avoiding them.

Common Crypto Pitfalls to Avoid

A. Lack of research and due diligence:

One of the biggest mistakes that investors make when investing in cryptocurrencies is failing to do their research. It's essential to understand the underlying technology and value proposition of a cryptocurrency before investing in it. Additionally, investors should research the team behind the project, as well as its market cap, trading volume, and potential use cases.

B. FOMO (Fear of Missing Out) investing:

FOMO is a powerful force that can lead investors to make impulsive and irrational investment decisions. When a cryptocurrency is experiencing a sudden price surge, it's tempting to jump in and invest without doing proper research or considering the potential risks. However, this can lead to significant losses if the market suddenly turns against you.

Also Read: The Ultimate Guide to Crypto Trading Chart Patterns for Beginners

C. Not understanding market trends and volatility:

The cryptocurrency market is highly volatile and subject to sudden price swings. It's essential to understand the underlying market trends and the factors that can influence the price of a cryptocurrency. Investors should also be prepared for sudden market crashes and have a strategy in place for dealing with them.

D. Investing more than you can afford to lose:

This is a common mistake that many investors make, not just in the cryptocurrency market but in any type of investment. It's important to invest only what you can afford to lose, and not to put your entire life savings into a single investment. Diversification is key to managing risk and maximizing returns.

In the next section, we'll explore some cryptocurrency investing tips that can help investors avoid these common pitfalls and maximize their chances of success.

Cryptocurrency Investing Tips

A. Importance of setting investment goals:

Before investing in cryptocurrencies, it's important to set clear investment goals. This will help you to determine the type of investments that are best suited to your needs and risk tolerance. Are you looking for short-term gains or long-term investments? Do you want to focus on a particular type of cryptocurrency or invest in a diversified portfolio? Answering these questions will help you to make more informed investment decisions.

B. Diversifying your portfolio:

Diversification is key to managing risk and maximizing returns in the cryptocurrency market. Investing in a variety of different cryptocurrencies can help to spread your risk and reduce your exposure to any single asset. This can help to mitigate the impact of sudden price swings and market crashes.

Also Read: Crypto Staking: How It Works and How to Get Started

C. Staying up-to-date with industry news and trends:

The cryptocurrency market is constantly evolving, and it's important to stay up-to-date with the latest news and trends. Following reputable sources of information, such as industry publications, social media channels, and online forums, can help you to stay informed about the latest developments in the market. This can help you to make more informed investment decisions.

D. Keeping emotions in check when making investment decisions:

Investing in cryptocurrencies can be an emotional experience, especially when prices are rapidly rising or falling. It's important to keep your emotions in check and make investment decisions based on rational analysis and research. Avoid making impulsive decisions based on fear, greed, or FOMO.

In the next section, we'll explore some strategies for maximizing your crypto returns.

Also Read: Top 10 Cryptocurrencies to Watch in 2023

Maximizing Crypto Returns

A. Long-term investment strategy:

One of the best ways to maximize your returns in the cryptocurrency market is to adopt a long-term investment strategy. This means holding onto your investments for an extended period of time, rather than trying to make short-term gains through day trading or market timing. Over the long run, the cryptocurrency market has shown strong growth potential, and adopting a long-term approach can help you to take advantage of this.

B. Dollar-cost averaging:

Dollar-cost averaging is a strategy that involves investing a fixed amount of money at regular intervals, regardless of the current price of the cryptocurrency. This can help to smooth out the impact of market volatility and allow you to accumulate more units of the cryptocurrency over time.

C. Taking profits and rebalancing your portfolio:

It's important to take profits periodically and rebalance your portfolio to maintain your desired asset allocation. This means selling off some of your investments when they have reached your target price and reinvesting the proceeds in other assets to maintain a balanced portfolio.

D. Using technical analysis and market indicators:

Technical analysis and market indicators can be useful tools for identifying trends and potential buying or selling opportunities in the cryptocurrency market. This can help you to make more informed investment decisions and maximize your returns.

By following these tips and strategies, you can avoid common mistakes when investing in cryptocurrencies and maximize your chances of success in this exciting and rapidly evolving market. Remember to always do your research, stay informed, and keep your emotions in check when making investment decisions.

Also Read: Top Crypto Tax Platforms for Hassle-Free Tax Filing

Crypto Investment Strategies

A. Fundamental analysis:

Fundamental analysis involves evaluating the underlying value of a cryptocurrency based on factors such as its technology, adoption rate, and overall market potential. By analyzing these factors, you can make more informed investment decisions and identify cryptocurrencies that have strong long-term growth potential.

B. Technical analysis:

Technical analysis involves analyzing charts and using indicators to identify trends and potential buying or selling opportunities in the market. This can help you to make more informed short-term investment decisions and take advantage of market fluctuations.

Also Read: Is cryptocurrency a good investment?

D. Value investing:

Value investing involves identifying undervalued cryptocurrencies that have strong long-term growth potential. By investing in these undervalued assets, you can potentially earn higher returns as their value increases over time.

E. Momentum investing:

Momentum investing involves investing in cryptocurrencies that have recently experienced strong price increases, with the expectation that they will continue to rise in value. This strategy requires careful monitoring of market trends and an ability to take advantage of short-term buying opportunities.

F. Dollar-cost averaging:

As mentioned earlier, dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the current price of the cryptocurrency. This strategy can be particularly effective for long-term investments, as it allows you to accumulate more units of the cryptocurrency over time.

By combining these different investment strategies, you can create a diversified portfolio that maximizes your chances of success in the cryptocurrency market. Remember to always do your research, stay informed, and take a long-term perspective when investing in cryptocurrencies.

Keeping Your Crypto Secure with a Hardware Wallet

One of the most important aspects of investing in cryptocurrencies is keeping your assets secure. With the increasing prevalence of hacks, scams, and other security threats in the cryptocurrency market, it's more important than ever to take steps to protect your investments.

Also Read: Secure Your Crypto Assets with the Best Crypto Hardware Wallets

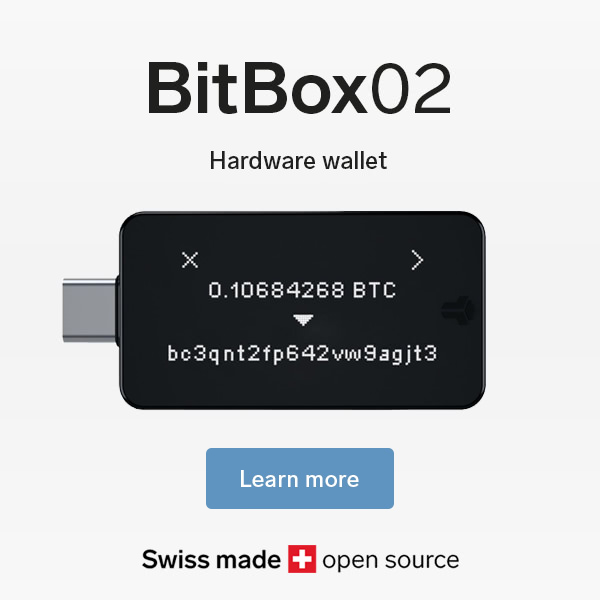

One of the best ways to keep your cryptocurrency secure is by using a hardware wallet. A hardware wallet is a specialized device that allows you to securely store your cryptocurrency offline, away from the internet and potential security threats.

There are several reputable hardware wallet options available, including the Ledger Nano X, Trezor T, Coldcard, and BitBox02. Each of these wallets offers advanced security features and user-friendly interfaces to help you manage your cryptocurrency investments.

When using a hardware wallet, be sure to follow the manufacturer's instructions carefully and keep your device in a safe and secure location. Remember to always keep your seed phrase, which serves as a backup for your wallet, in a secure place and never share it with anyone.

Also Read: Cold Wallet vs Hot Wallet: What's the Difference and Which Should You Use?

By using a hardware wallet and taking other necessary security precautions, you can help protect your cryptocurrency investments and invest with confidence in the rapidly evolving cryptocurrency market.

Ledger Nano X buy official link: Secure your crypto assets with peace of mind by purchasing a Ledger Nano X through our official link today!

Trezor T official buy link: Secure your crypto assets with peace of mind by purchasing a Trezor T through our official link today!

Coldcard official buy link: Secure your crypto assets with peace of mind by purchasing a Coldcard through our official link today!

BitBox02 official buy link: Secure your crypto assets with peace of mind by purchasing a BitBox02 through our official link today!

Conclusion

Investing in cryptocurrencies can be a highly rewarding and exciting experience, but it's important to be aware of the potential pitfalls and risks involved. By avoiding common mistakes, following sound investment strategies, and staying informed about the latest trends and developments in the market, you can maximize your chances of success and achieve your investment goals.

Also Read: A Beginner's Guide to Bitcoin Mining with Kryptex: How to Get Started and Maximize Your Earnings

Remember to always do your research, invest with caution, and take a long-term perspective when investing in cryptocurrencies. By adopting a disciplined and informed approach, you can navigate the complex and rapidly evolving cryptocurrency market and potentially earn significant returns on your investment.

Finally, be sure to stay up-to-date on the latest news and trends in the cryptocurrency industry. Join online communities, read reputable sources, and consider consulting with a financial advisor who specializes in cryptocurrencies to help guide you along the way.

Good luck, and happy investing!

Join TradingView today for the ultimate trading experience!

0 Comments

Post a Comment