I. Introduction

Blockchain technology has been gaining momentum over the past decade, revolutionizing the way we transact, store, and share data. It is an immutable and decentralized ledger that allows transactions to be recorded and verified without the need for intermediaries. The impact of blockchain technology on various industries has been significant, and it has the potential to disrupt traditional business models in the future.

A. Definition of Blockchain and Its Impact on Industries:

Blockchain is a distributed ledger technology that records and stores data in a secure, decentralized manner. It is a chain of blocks that contain transaction data, and once a block is added to the chain, it cannot be altered or deleted. Blockchain technology has already had a significant impact on various industries, including finance, healthcare, supply chain management, and more.

For instance, blockchain technology has revolutionized the finance industry by enabling faster and more secure transactions. It has also made it possible to create new financial products and services that were not possible before. Blockchain technology has also transformed the healthcare industry by improving the management of medical records and the tracking of drugs through the supply chain.

B. Importance of Keeping Up with the Latest Blockchain Trends:

Blockchain technology is constantly evolving, and it is essential to keep up with the latest trends and developments in the industry. This is important for individuals and businesses that want to leverage blockchain technology to improve their operations and stay competitive.

Staying up-to-date with the latest blockchain trends can also help individuals and businesses to identify new opportunities and potential use cases for blockchain technology. For example, the rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) has created new opportunities for individuals and businesses to participate in the blockchain ecosystem.

In summary, blockchain technology has the potential to disrupt traditional business models, and staying up-to-date with the latest blockchain trends is critical to take advantage of the new opportunities it presents. The next section will explore the first trend in our list, security tokens.

II. Security Tokens

Security tokens are digital tokens that represent ownership of a real-world asset, such as equity, debt, or real estate. They are issued on a blockchain network and are subject to regulatory compliance. Security tokens offer several benefits over traditional securities, including improved liquidity, fractional ownership, and 24/7 trading.

A. Definition and Benefits of Security Tokens:

Security tokens are a type of blockchain-based token that represents ownership of an asset, such as equity, debt, or real estate. Unlike traditional securities, security tokens are issued and traded on a blockchain network. This provides several benefits, including improved liquidity, fractional ownership, and reduced transaction costs.

Security tokens are also subject to regulatory compliance, which provides investors with a higher degree of protection than traditional cryptocurrencies. This makes security tokens a more attractive investment option for institutional investors and traditional financial institutions.

B. Use Cases and Adoption in Industries:

Security tokens have a wide range of use cases across various industries. For example, in the real estate industry, security tokens can be used to fractionalize ownership of a property, enabling smaller investors to participate in real estate investments that were previously inaccessible to them.

In the financial industry, security tokens can be used to represent ownership of assets such as stocks, bonds, and derivatives. This can streamline the trading process, reduce transaction costs, and improve liquidity.

The adoption of security tokens has been slow due to regulatory uncertainty and the lack of infrastructure. However, some countries have already started to regulate security tokens, and more are expected to follow suit. As the regulatory environment becomes more favorable, the adoption of security tokens is expected to increase.

C. Future Outlook:

The future of security tokens looks promising, with more companies and investors starting to recognize the benefits of blockchain-based securities. As the regulatory environment becomes more favorable, we can expect to see increased adoption of security tokens across various industries.

In addition, the development of decentralized exchanges (DEXs) and the improvement of existing infrastructure will make it easier for investors to trade security tokens. This, in turn, will improve liquidity and reduce transaction costs, making security tokens a more attractive investment option for both institutional and retail investors.

In summary, security tokens have the potential to revolutionize the way we trade and invest in securities. As the regulatory environment becomes more favorable and infrastructure improves, we can expect to see increased adoption of security tokens across various industries.

Also Read: What are the 4 types of cryptocurrency?

III. Blockchain Consortia

A. Definition and Benefits of Blockchain Consortia:

A blockchain consortium is a group of companies that work together to develop and implement blockchain-based solutions. By pooling their resources and expertise, members of a consortium can accelerate the development and adoption of blockchain technology, while reducing costs and risks.

One of the main benefits of blockchain consortia is the ability to collaborate on the development of shared standards and protocols. This can help to reduce fragmentation in the blockchain industry and promote interoperability between different blockchain networks.

Blockchain consortia can also help to address issues of scalability and security, as members can work together to develop solutions that are more robust and scalable than individual companies could achieve on their own.

B. Examples of Successful Consortia:

There are several successful blockchain consortia that have emerged in recent years. One example is the Enterprise Ethereum Alliance (EEA), which brings together over 200 companies to collaborate on the development of blockchain-based solutions using the Ethereum platform.

Another example is the R3 consortium, which focuses on developing blockchain solutions for the financial industry. The consortium includes over 80 banks and financial institutions and has developed several successful blockchain-based solutions, including Corda, a distributed ledger technology platform.

C. Potential Challenges and Solutions:

While blockchain consortia offer many benefits, there are also potential challenges to consider. One challenge is the issue of governance, as members may have different interests and objectives. This can lead to disagreements over the direction of the consortium and how resources should be allocated.

Another challenge is the issue of interoperability, as different blockchain networks may use different protocols and standards. To address this challenge, blockchain consortia can work to develop shared standards and protocols that promote interoperability between different networks.

Finally, blockchain consortia must also address issues of scalability and security, as the technology continues to evolve. Members of a consortium can work together to develop solutions that are more robust and scalable than individual companies could achieve on their own.

In summary, blockchain consortia offer many benefits for companies looking to develop and implement blockchain-based solutions. By working together, members can accelerate the development and adoption of blockchain technology, while reducing costs and risks. While there are potential challenges to consider, these can be addressed through collaboration and the development of shared standards and protocols.

Also Read: Understanding Consensus Algorithm in Blockchain: How it Works and Types

IV. Alternative Asset Classes

A. Definition and Benefits of Alternative Asset Classes on Blockchain:

Alternative asset classes refer to any assets that are not traditional securities or stocks, such as real estate, art, and collectibles. The use of blockchain technology in alternative asset classes has many benefits, including increased transparency, reduced costs, and improved accessibility.

By using blockchain technology, alternative asset classes can be tokenized and traded on a decentralized platform, which can help to reduce transaction costs and increase liquidity. Additionally, blockchain technology can provide a high degree of transparency, which can help to reduce the risk of fraud and improve investor confidence.

B. Examples of Successful Use Cases:

One successful use case of alternative asset classes on the blockchain is the real estate industry. By tokenizing real estate assets, investors can gain fractional ownership of properties and trade their own shares on a decentralized platform. This can help to reduce the costs and barriers to entry for real estate investment while increasing liquidity and transparency.

Another successful use case is the art industry. By tokenizing art assets, investors can gain fractional ownership of the artwork and trade their own shares on a decentralized platform. This can help to increase the accessibility of art investment and reduce the risk of fraud in the industry.

C. Future Potential:

The use of blockchain technology in alternative asset classes has significant potential for the future. As the technology continues to evolve, we can expect to see more innovative use cases and increased adoption in industries beyond real estate and art.

For example, alternative asset classes such as wine, collectibles, and even intellectual property could be tokenized and traded on a decentralized platform, increasing accessibility and liquidity for investors. Additionally, the use of blockchain technology could help to reduce the costs and barriers to entry for alternative asset investment, opening up new opportunities for a wider range of investors.

In summary, the use of blockchain technology in alternative asset classes offers many benefits, including increased transparency, reduced costs, and improved accessibility. Successful use cases in industries such as real estate and art demonstrate the potential for future innovation and adoption in a wider range of industries.

Also Read: Decoding Blockchain: Everything You Need to Know in Layman's Terms

V. Stablecoins

A. Definition and Benefits of Stablecoins:

Stablecoins are a type of cryptocurrency that is designed to maintain a stable value, typically pegged to a stable asset such as a fiat currency or a commodity. The primary benefit of stablecoins is their stability, which makes them less volatile than other cryptocurrencies and more suitable for use in everyday transactions.

Stablecoins can also provide many other benefits, such as increased security, reduced transaction costs, and faster transaction times compared to traditional payment methods. Additionally, stablecoins can help to address issues of volatility and uncertainty that are often associated with traditional cryptocurrencies, making them more appealing to mainstream users and businesses.

B. Types of Stablecoins and Their Use Cases:

There are several types of stablecoins, including fiat-collateralized stablecoins, commodity-collateralized stablecoins, and algorithmic stablecoins. Each type of stablecoin has its own unique use cases and benefits.

Fiat-collateralized stablecoins are backed by fiat currency reserves, such as USD or EUR. These stablecoins are typically the most popular type, as they provide a direct and stable link to traditional currencies. Commodity-collateralized stablecoins are backed by a commodity such as gold or oil, providing a stable value based on the price of the underlying commodity.

Algorithmic stablecoins, on the other hand, use complex algorithms to maintain a stable value. These stablecoins are typically not backed by any collateral and instead rely on market mechanisms to adjust the supply of the stablecoin in response to changes in demand.

C. Future Outlook:

The future of stablecoins is bright, as they continue to gain popularity and adoption in the cryptocurrency market. The stable value and other benefits of stablecoins make them attractive for use in a wide range of industries and applications, including cross-border payments, remittances, and e-commerce.

As the adoption of stablecoins continues to grow, we can expect to see new innovations and use cases emerging. For example, stablecoins could be used to create decentralized lending and borrowing platforms or to provide stable value tokens for use in decentralized finance (DeFi) applications.

In summary, stablecoins are a type of cryptocurrency that provides a stable value, making them less volatile than other cryptocurrencies and more suitable for everyday use. There are several types of stablecoins, each with its own unique benefits and use cases. As the adoption of stablecoins continues to grow, we can expect to see new innovations and applications emerging in the cryptocurrency market.

Also Read: The Ultimate List of Stablecoins in 2023: Safest Options Included

VI. Blockchain-as-a-Service

A. Definition and Benefits of Blockchain-as-a-Service

Blockchain-as-a-Service (BaaS) is a cloud-based solution that enables businesses to build, host, and deploy their own blockchain applications. BaaS providers offer pre-built blockchain templates, tools, and APIs that can be integrated into existing applications, reducing the time and resources required to develop and deploy a blockchain network. BaaS can be used to develop a wide range of blockchain-based applications, such as smart contracts, supply chain management, and digital identity verification.

The benefits of BaaS are numerous. First, it reduces the barriers to entry for companies that want to adopt blockchain technology but lack the expertise and resources to build and maintain their own blockchain infrastructure. BaaS providers also offer a secure and scalable environment for blockchain applications, which can be expensive to set up and maintain in-house. Additionally, BaaS can provide cost savings by eliminating the need for upfront capital investments in infrastructure and staffing.

B. Examples of Successful Providers

There are several successful BaaS providers in the market today, including Microsoft Azure, IBM Blockchain Platform, Amazon Web Services (AWS), and Oracle Blockchain. Microsoft Azure provides a wide range of blockchain services, including Ethereum and Hyperledger Fabric. IBM Blockchain Platform offers a complete set of blockchain tools, including a blockchain network, a development platform, and an operations console. AWS provides Amazon Managed Blockchain, which offers pre-built blockchain templates for Ethereum and Hyperledger Fabric. Oracle Blockchain provides a pre-assembled blockchain platform that enables companies to easily integrate blockchain technology into their existing systems.

C. Potential Challenges and Solutions

One potential challenge with BaaS is the lack of customization options. Because BaaS providers offer pre-built blockchain templates, businesses may be limited in their ability to customize the blockchain to their specific needs. Another challenge is the potential for vendor lock-in, where businesses may be dependent on a specific BaaS provider for their blockchain infrastructure.

To address these challenges, businesses should carefully evaluate BaaS providers and choose a provider that offers the customization and flexibility they require. Additionally, businesses should consider using open-source blockchain solutions, which provide more flexibility and customization options. Finally, businesses should consider developing their own in-house blockchain infrastructure if they have the expertise and resources to do so.

Also Read: Exploring the Advantages of Blockchain as a Service (BaaS)

VII. Hybrid Models

A. Definition and benefits of hybrid models

Hybrid models in blockchain refer to a combination of public and private blockchains. In other words, it is a model that allows for a mix of permission and permissionless blockchain technology. The benefits of a hybrid model include increased security, scalability, and privacy, as well as the ability to customize the blockchain to meet specific business needs.

B. Examples of successful hybrid models

One example of a successful hybrid model is the Hyperledger Fabric blockchain, which is a permission blockchain that allows for customizable smart contracts. Another example is the Polkadot blockchain, which uses a hybrid model to connect multiple blockchains, allowing for interoperability and increased scalability.

C. Future potential

The future potential of hybrid models in the blockchain is significant, as they offer the benefits of both public and private blockchains. As businesses continue to explore the use of blockchain technology, hybrid models will likely become more prevalent, especially in industries where privacy and security are paramount, such as healthcare and finance. Additionally, hybrid models could help to address some of the scalability and interoperability challenges currently facing blockchain technology. Overall, the future looks bright for hybrid models in blockchain, and we can expect to see continued growth and adoption in the years to come.

Also Read: Exploring the Advantages and Limitations of Hybrid Blockchain Technology

VIII. Data Marketplaces

A. Definition and benefits of data marketplaces on the blockchain

A data marketplace on the blockchain is a platform that facilitates the exchange of data between individuals or organizations in a secure and decentralized manner. Blockchain technology ensures that data is stored securely and transparently, while smart contracts automate the exchange process, making it more efficient and cost-effective. The benefits of data marketplaces on blockchain include increased security, privacy, and transparency, as well as the ability to monetize data in a fair and equitable way.

B. Examples of successful use cases

One example of a successful data marketplace on the blockchain is Ocean Protocol, which provides a decentralized platform for individuals and organizations to share and monetize data. Another example is Datum, which uses blockchain technology to create a secure and transparent marketplace for personal data.

C. Future outlook

The future outlook for data marketplaces on blockchain is promising, as the demand for data continues to grow and businesses seek more efficient and secure ways to exchange information. Blockchain technology provides a natural fit for data marketplaces, as it offers the necessary security, privacy, and transparency features required for successful data exchange. As more businesses adopt blockchain technology and data marketplaces become more widely used, we can expect to see increased innovation and growth in this area. Additionally, with the rise of machine learning and artificial intelligence, data marketplaces on blockchain could play an increasingly important role in facilitating the development of these technologies. Overall, the future looks bright for data marketplaces on blockchain, and we can expect to see continued growth and adoption in the years to come.

Also Read: Deeper Network VPN - The Best Decentralized VPN for Privacy and Security

IX. Converging with the Internet of Things

A. Definition and benefits of the convergence of blockchain and the Internet of Things

Blockchain and the Internet of Things (IoT) are two innovative technologies that have the potential to transform various industries. The convergence of these two technologies involves the integration of IoT devices with a blockchain network to create a decentralized and secure system for data storage and exchange.

The benefits of the convergence of blockchain and IoT are numerous. Firstly, it enhances the security and privacy of data by creating an immutable and tamper-proof ledger. The decentralized nature of blockchain ensures that data is not controlled by a single entity, reducing the risk of a single point of failure or a cyber-attack. Secondly, the integration of IoT devices with blockchain can help to create new business models and revenue streams. For example, it can facilitate machine-to-machine transactions and enable the creation of autonomous systems.

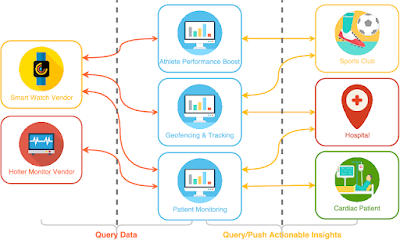

B. Use cases and adoption in industries

The convergence of blockchain and IoT has already found applications in various industries. For instance, in the logistics and supply chain industry, the integration of IoT devices with blockchain can help to improve transparency and traceability. IoT sensors can be used to monitor the location and condition of goods in transit, while blockchain can be used to store this data securely and immutably.

In the energy sector, the convergence of blockchain and IoT can help to create a more efficient and secure energy grid. IoT sensors can be used to monitor energy production and consumption, while blockchain can be used to create a decentralized energy trading platform, enabling peer-to-peer energy trading.

The healthcare industry is another sector that could benefit from the convergence of blockchain and IoT. IoT devices can be used to monitor patient health and transmit this data to healthcare providers securely via a blockchain network. This can help to improve patient outcomes and reduce healthcare costs.

C. Future outlook

The convergence of blockchain and IoT is still in its early stages, but the potential for these two technologies to transform various industries is enormous. In the future, we can expect to see more use cases and applications of this technology as it becomes more widely adopted. As more IoT devices are connected to blockchain networks, the demand for blockchain-as-a-service (BaaS) providers will also increase.

One potential challenge that needs to be addressed is the scalability of blockchain networks. IoT devices generate vast amounts of data, and blockchain networks may struggle to handle this volume of data. However, solutions such as sharding and off-chain transactions are being developed to address this challenge.

In summary, the convergence of blockchain and IoT has the potential to transform various industries by improving security, creating new business models, and enabling more efficient systems. As the adoption of these technologies increases, we can expect to see more innovative use cases and applications in the future.

Also Read: Secure Your Internet with a Decentralized VPN: Introducing Deeper Network

X. Decentralized Ecosystem Platforms

A. Definition and Benefits of Decentralized Ecosystem Platforms

Decentralized Ecosystem Platforms (DEPs) are blockchain-based systems that allow individuals and organizations to develop and operate decentralized applications (DApps) that interact with each other in a peer-to-peer network. DEPs provide a secure and transparent environment for DApps to operate, eliminating the need for centralized intermediaries. DEPs offer several benefits, including improved security, data privacy, and scalability.

One of the primary benefits of DEPs is their ability to provide a trustless environment for developers and users to interact. By removing the need for centralized intermediaries, DEPs eliminate the risk of a single point of failure. Additionally, DEPs provide a transparent environment that allows developers to access information on user behavior and preferences. This information can be used to create better user experiences and increase engagement.

B. Examples of Successful Platforms

Several successful DEPs are already in operation, offering a variety of DApps and services. One such platform is Ethereum, which is the second-largest cryptocurrency by market capitalization. Ethereum is a decentralized platform that allows developers to create DApps using smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. Ethereum has enabled the development of a wide range of decentralized applications, including decentralized finance (DeFi) platforms, supply chain management systems, and online marketplaces.

Another successful DEP is EOS, which is a blockchain-based platform for the development of DApps. EOS offers several advantages over other blockchain platforms, including high-speed transactions, scalability, and flexibility. EOS has been used to develop several successful DApps, including social media platforms, gaming platforms, and decentralized marketplaces.

C. Future Potential

The future potential of DEPs is vast and varied. As blockchain technology continues to mature, DEPs are likely to become increasingly sophisticated and efficient. One area in which DEPs are expected to play a significant role is in the development of DeFi platforms, which are designed to provide financial services using decentralized systems. DEPs are also expected to be used in the development of supply chain management systems, digital identity verification systems, and online voting systems.

In conclusion, DEPs are an important development in the blockchain industry, offering significant benefits to developers and users alike. With the continued growth and maturity of blockchain technology, DEPs are likely to become increasingly important in a wide range of industries and applications.

Also Read: Exploring the Future of Blockchain Technology: Latest Trends and Development Insights for 2023

XI. Blockchain Interoperability

A. Definition and benefits of blockchain interoperability

Blockchain interoperability refers to the ability of different blockchain networks to communicate and share information with each other. It enables the transfer of data and assets between disparate blockchains, creating a more interconnected ecosystem.

The benefits of blockchain interoperability are numerous. First, it allows for greater efficiency in the transfer of assets and information. By removing the need for intermediaries and enabling direct peer-to-peer transactions, interoperability can reduce transaction costs and increase speed. Additionally, it enhances the overall security and resilience of the blockchain ecosystem by enabling greater redundancy and reducing the risk of a single point of failure.

B. Use cases and adoption in industries

Blockchain interoperability has numerous potential use cases across a variety of industries. One key area where it could have a significant impact is in the financial sector. Interoperability could allow for the seamless transfer of assets between different blockchains, enabling greater liquidity and efficiency in financial markets. Additionally, it could enable the creation of new financial products and services that bridge different blockchain networks.

Another potential use case for blockchain interoperability is in supply chain management. By enabling different blockchains to communicate and share data, interoperability could help to create a more transparent and efficient supply chain ecosystem. This could lead to greater accountability, reduced costs, and improved tracking of goods and products.

C. Potential challenges and solutions

Despite the potential benefits of blockchain interoperability, there are also a number of challenges that need to be addressed in order to achieve widespread adoption. One key challenge is the lack of standardization across different blockchain networks. Without common standards and protocols, it can be difficult for different blockchains to communicate with each other.

Another challenge is the issue of scalability. As more and more blockchains are added to the ecosystem, there is a risk that interoperability could become increasingly complex and difficult to manage. Additionally, there are concerns about security and the risk of malicious actors exploiting vulnerabilities in the interoperability layer.

To address these challenges, there are a number of potential solutions being explored. One approach is to develop common standards and protocols for blockchain interoperability, such as the Interledger Protocol (ILP). Another approach is to use sidechains or other off-chain solutions to enable interoperability while reducing the complexity of the network. Ultimately, achieving widespread adoption of blockchain interoperability will require collaboration and coordination across different blockchain networks and stakeholders.

Also Read: Unlocking the Potential of Crypto with Blockchain Interoperability

XII. Conclusion

A. Recap of the top 10 blockchain trends for 2023

In this article, we have discussed the top 10 blockchain trends that are expected to shape the industry in 2023. These trends include Security Tokens, Blockchain Consortia, Alternative Asset Classes, Stablecoins, Blockchain-as-a-Service, Hybrid Models, Data Marketplaces, Converging with the Internet of Things, Decentralized Ecosystem Platforms, and Blockchain Interoperability.

Security tokens offer a unique way to invest in assets and are becoming increasingly popular. Blockchain consortia provide a collaborative approach to blockchain adoption. Alternative asset classes on the blockchain are expanding the reach of investment opportunities. Stablecoins offer stability and security in a volatile market. Blockchain-as-a-Service providers offer easy and affordable access to blockchain technology. Hybrid models combine public and private blockchains to provide the benefits of both. Data marketplaces offer a secure and transparent way to monetize data. Converging with the Internet of Things creates a new level of automation and security. Decentralized ecosystem platforms provide a way to build complex blockchain applications. Blockchain interoperability allows for the seamless integration of multiple blockchains.

B. Importance of staying up-to-date with the latest trends in the industry

As the blockchain industry continues to evolve and grow, it is essential to stay up-to-date with the latest trends and developments. By understanding these trends, individuals and businesses can gain a competitive edge and identify new opportunities for growth and innovation.

Staying up-to-date with the latest trends can also help individuals and businesses make informed decisions about how to invest in and adopt blockchain technology. By understanding the potential benefits and challenges of different blockchain trends, individuals and businesses can make better decisions about how to leverage blockchain for their specific needs.

In conclusion, the blockchain industry is constantly evolving, and staying up-to-date with the latest trends is crucial for success. By understanding and embracing these trends, individuals and businesses can position themselves for success in the years to come.

Related Articles:

- Top 8 Best Cold Wallets for Crypto in 2023: Keep Your Coins Safe

- SecuX Review: Is SecuX W20 the Best Cryptocurrency Hardware Wallet?

- The Ultimate Ellipal Wallet Review: Best Crypto Hardware Wallet for Secure Storage

- Safepal Hardware Wallet Review: The Best Way to Secure Your Crypto Assets

- Secure Your Crypto Assets with the Best Crypto Hardware Wallets

- Cold Wallet vs Hot Wallet: What's the Difference and Which Should You Use?

- Is Trezor the Best Hardware Wallet for Your Crypto? Our In-Depth Review

0 Comments

Post a Comment