Welcome to an informative exploration of Pendle Finance, a trailblazing platform in the realm of decentralized finance (DeFi). In this article, we delve into the features, benefits, and potential of Pendle Finance, offering valuable insights to readers seeking to optimize their yield-generation strategies. With a focus on providing high-quality, informative, and engaging content, we aim to shed light on the significance of Pendle Finance and its role in revolutionizing the world of yield markets in DeFi. Through an SEO-optimized approach, we ensure maximum visibility and reach for readers interested in the remarkable opportunities presented by Pendle Finance.

I. Introduction

A. Brief explanation of Pendle Finance and its significance in decentralized finance (DeFi)

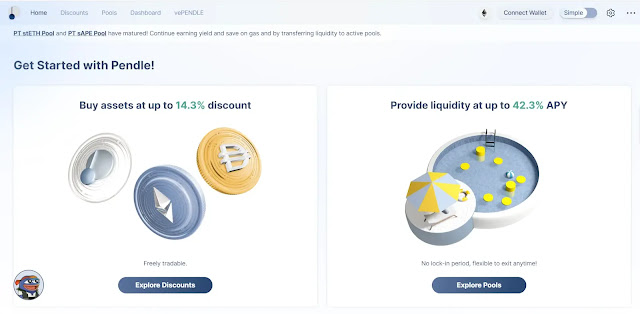

Pendle Finance is a cutting-edge decentralized finance (DeFi) protocol that has been gaining traction in the crypto space. It offers a unique solution to the challenges faced by yield markets, revolutionizing the way users interact with future yields. By leveraging the power of blockchain technology, Pendle Finance enables users to tokenize and trade their future yields, providing enhanced liquidity and flexibility in the DeFi ecosystem.

In the world of decentralized finance, yield generation has become a prominent avenue for users to earn passive income. However, traditional methods of yield farming often lack flexibility and liquidity. This is where Pendle Finance comes into play, offering a groundbreaking approach that allows users to unlock the value of their future income streams.

B. Overview of the main goal of the article: Explaining the features and benefits of Pendle Finance

The main goal of this article is to delve into the features and benefits of Pendle Finance, shedding light on how it is reshaping the DeFi landscape. By exploring the protocol's innovative functionalities, readers will gain a comprehensive understanding of how Pendle Finance operates and how it can benefit them.

We will delve into the process of yield tokenization, which lies at the heart of Pendle Finance. This process involves converting future yields into tradeable tokens known as Pendle Tokens. These tokens enable users to effectively trade and monetize their future yields, providing increased liquidity and tradability. Through Pendle Finance, users can unlock the value of their yields and gain access to a range of exciting opportunities within the DeFi ecosystem.

Furthermore, we will discuss the key features offered by Pendle Finance, such as yield farming and staking options. These features provide users with additional ways to maximize their yield opportunities and earn rewards. We will also explore the advantages of Pendle Finance, including enhanced liquidity, flexibility, and the potential for capitalizing on market opportunities.

As we delve into the features and benefits, it is important to acknowledge the potential risks and cons associated with using Pendle Finance. Market volatility, smart contract vulnerabilities, and other factors can impact the performance of DeFi protocols. Therefore, it is crucial for users to exercise caution and conduct thorough research before engaging with Pendle Finance or any other DeFi platform.

By the end of this article, readers will have a comprehensive understanding of Pendle Finance and its potential for transforming the yield market. Whether you are a seasoned DeFi enthusiast or a newcomer to the world of decentralized finance, this article will equip you with the knowledge needed to explore Pendle Finance and make informed decisions regarding your investment strategies.

Click Here & Make Your Crypto Work for You >>

II. Understanding Pendle Finance

A. Definition and purpose of Pendle Finance

Pendle Finance is an innovative decentralized finance (DeFi) protocol designed to address the challenges faced by yield markets. Its core purpose is to provide users with the ability to tokenize and trade their future yields, unlocking liquidity and flexibility within the DeFi ecosystem. By leveraging blockchain technology, Pendle Finance aims to revolutionize the way users interact with yield generation and income streams.

B. Tokenization of future yields and its role in Pendle Finance

At the heart of Pendle Finance lies the concept of yield tokenization. This process involves converting future yields, which are typically locked and inaccessible, into tradeable tokens known as Pendle Tokens. These tokens represent the value of future yields, allowing users to trade and monetize their income streams before they mature.

The tokenization of future yields plays a crucial role in Pendle Finance by providing users with liquidity and flexibility. It allows them to access the value of their yields in the present, enabling trading and investment opportunities that were previously unavailable. Through Pendle Finance, users can effectively manage and optimize their yield-generating assets.

C. How Pendle Tokens represent future yields and provide liquidity

Pendle Tokens serve as a representation of future yields within the Pendle Finance ecosystem. When users supply their assets into Pendle Finance liquidity pools, they receive Pendle Tokens in return. These tokens are backed by the future income streams generated by those assets.

The Pendle Tokens can then be freely traded on decentralized exchanges, providing liquidity to the users. This liquidity enables the buying and selling of future yields, allowing users to unlock value and maximize their yield opportunities. By representing future yields in tokenized form, Pendle Finance introduces a new level of traceability and accessibility to the DeFi landscape.

D. Integration of Pendle Finance with the Ethereum blockchain

Pendle Finance is built on the Ethereum blockchain, taking advantage of its robust infrastructure and smart contract capabilities. By integrating with Ethereum, Pendle Finance ensures the security and reliability of its protocol, leveraging the well-established ecosystem and the wide array of existing DeFi applications.

The integration with Ethereum enables seamless interoperability with other DeFi protocols and platforms. Users can interact with Pendle Finance using popular Ethereum wallets and interfaces, making it convenient for DeFi enthusiasts to access and utilize the features offered by Pendle Finance.

Furthermore, by operating on Ethereum, Pendle Finance aligns itself with the broader DeFi community, fostering collaboration and potential integrations with other projects. This integration enhances the overall ecosystem and contributes to the growth and development of decentralized finance as a whole.

III. Features of Pendle Finance

A. Yield farming and staking options

Pendle Finance offers users the opportunity to engage in yield farming and staking, enabling them to earn additional rewards on their assets. Yield farming involves providing liquidity to Pendle Finance's yield markets and earning Pendle Tokens as rewards. These tokens can then be staked in the platform's staking pools, allowing users to earn further rewards in the form of additional Pendle Tokens or other tokens supported by Pendle Finance.

By participating in yield farming and staking, users can maximize their potential returns while actively contributing to the liquidity and stability of the Pendle Finance ecosystem. It presents an avenue for users to put their idle assets to work and earn passive income through the various yield-generating opportunities provided by Pendle Finance.

B. Trading Pendle Tokens for increased flexibility

Pendle Tokens, representing future yields, can be freely traded on decentralized exchanges. This trading capability provides users with increased flexibility and the ability to manage their income streams more effectively. Users can choose to hold onto their Pendle Tokens until the future yields mature, or they can trade them on the open market for other tokens or assets.

The trading of Pendle Tokens allows users to capitalize on market opportunities and make strategic decisions based on their investment preferences and risk appetite. It enhances the overall liquidity of the ecosystem and provides users with the freedom to customize their investment strategies according to their individual needs and market conditions.

C. Hedging risks and capitalizing on market opportunities

One of the notable advantages of Pendle Finance is its ability to enable users to hedge risks and capitalize on market opportunities. By tokenizing and trading future yields, users can effectively hedge against potential price fluctuations and volatility. They can lock in the value of their yields in advance, mitigating the risks associated with unpredictable market conditions.

Furthermore, Pendle Finance empowers users to capitalize on market opportunities by allowing them to trade future yields. This flexibility enables users to take advantage of favorable yield rates or invest in alternative income streams that align with their investment objectives. It opens up a range of possibilities for users to optimize their yield generation and adapt to changing market dynamics.

D. Support for various DeFi protocols and their yields

Pendle Finance is designed to support various decentralized finance (DeFi) protocols and their yields. It integrates with other popular protocols, allowing users to access and trade a diverse range of yield-generating assets. This compatibility expands the opportunities available to users, enabling them to participate in different DeFi ecosystems and diversify their yield-generating strategies.

Through Pendle Finance, users can tap into the yields generated by protocols such as Aave, Compound, and Curve Finance, among others. This support for various DeFi protocols broadens the scope of income streams that users can tokenize, trade, and leverage for increased yield opportunities.

IV. Benefits of Pendle Finance

A. Enhanced liquidity and trading options for yield markets

Pendle Finance brings enhanced liquidity and trading options to the world of yield markets in decentralized finance (DeFi). By tokenizing future yields and creating Pendle Tokens, users can unlock the value of their income streams and trade them on decentralized exchanges. This introduces a new level of liquidity, allowing users to buy, sell, and trade their future yields, providing more flexibility and accessibility in the market.

The increased liquidity in yield markets empowers users to make more efficient use of their assets, enabling them to capitalize on favorable market conditions and seize profitable opportunities. By offering enhanced trading options, Pendle Finance ensures that users have the freedom to manage their income streams effectively, optimize their portfolios, and adapt to changing market dynamics.

B. Unlocking the value of future income streams

Pendle Finance enables users to unlock the value of their future income streams by tokenizing them into Pendle Tokens. Previously, future yields were often locked and inaccessible, limiting users' ability to capitalize on their potential value. However, with Pendle Finance, users can convert these future yields into tradeable tokens, effectively unlocking their value in the present.

This feature provides users with greater financial flexibility and control over their assets. They no longer have to wait for yields to mature to access their value. By tokenizing future income streams, Pendle Finance empowers users to utilize their assets more efficiently, potentially generating additional income and maximizing the overall value of their investment portfolio.

C. Potential for maximizing yield opportunities

Pendle Finance opens up a world of possibilities for users to maximize their yield opportunities within the DeFi ecosystem. By providing access to various yield-generating protocols and allowing the trading of Pendle Tokens, users can strategically allocate their assets and participate in a diverse range of income streams.

The flexibility and traceability offered by Pendle Finance enable users to adapt their investment strategies based on changing market conditions, capitalizing on the most promising yield opportunities. Whether it's taking advantage of high yield rates, exploring alternative income streams, or diversifying their portfolio, Pendle Finance empowers users to optimize their yield generation and potentially achieve higher returns on their investments.

D. Empowering users with greater control over their assets

Pendle Finance puts users in the driver's seat, granting them greater control over their assets and income streams. By providing the ability to tokenize and trade future yields, Pendle Finance ensures that users have ownership and agency over their financial resources.

Through Pendle Finance, users can actively manage and optimize their income-generating assets, tailoring their strategies to their specific financial goals and risk tolerance. They have the freedom to decide when and how to trade their Pendle Tokens, providing a level of control that was previously unattainable in traditional yield markets.

The increased control over assets not only enhances the user experience but also promotes financial empowerment and autonomy within the DeFi space. Pendle Finance enables users to take charge of their financial future and make informed decisions based on their unique circumstances and investment objectives.

V. Pros and Cons of Pendle Finance

A. Pros:

1. Increased liquidity and flexibility in yield markets

One of the significant advantages of Pendle Finance is the increased liquidity and flexibility it brings to yield markets. By tokenizing future yields into tradeable Pendle Tokens, users can unlock the value of their income streams and freely trade them on decentralized exchanges. This enhanced liquidity allows users to buy, sell, and trade their future yields, providing them with greater flexibility and accessibility in the market. It enables users to optimize their portfolios, capitalize on favorable market conditions, and potentially maximize their returns.

2. Ability to tokenize and trade future yields

Pendle Finance empowers users by enabling them to tokenize and trade their future yields. This feature unlocks the value of income streams that were previously inaccessible, allowing users to make immediate use of their potential earnings. By tokenizing future yields into Pendle Tokens, users gain control over their assets and can trade them on decentralized exchanges. This ability to tokenize future yields provides users with increased financial flexibility and the potential to generate additional income.

3. Potential for earning additional rewards through yield farming

Pendle Finance offers users the opportunity to participate in yield farming, which allows them to earn additional rewards on their assets. By providing liquidity to Pendle Finance's yield markets, users can earn Pendle Tokens as rewards. These tokens can then be staked in the platform's staking pools, allowing users to earn further rewards in the form of additional Pendle Tokens or other supported tokens. Yield farming presents users with the potential to generate passive income and maximize their overall returns.

B. Cons:

1. Risks associated with DeFi protocols and smart contract vulnerabilities

Like any decentralized finance (DeFi) platform, Pendle Finance is exposed to risks associated with DeFi protocols and smart contract vulnerabilities. While significant efforts are made to ensure the security and robustness of the platform, there is always a possibility of unforeseen vulnerabilities or exploits. Users must be aware of the inherent risks associated with interacting with DeFi platforms and exercise caution when participating in yield farming, staking, and trading activities.

2. Market volatility and potential for loss of investment

Participating in the cryptocurrency and DeFi markets involves inherent market volatility and the potential for the loss of investment. The value of Pendle Tokens and other assets can fluctuate significantly, and users should be prepared for the possibility of price volatility and potential losses. It's crucial for users to conduct thorough research, evaluate their risk tolerance, and make informed decisions when engaging with Pendle Finance or any other DeFi platform. Proper risk management strategies should be employed to mitigate potential losses.

It's important for users to consider both the advantages and risks associated with Pendle Finance before engaging with the platform. By being aware of the pros and cons, users can make informed decisions and navigate the DeFi landscape more effectively. In the following section, we will provide guidance on how to get started with Pendle Finance and offer some best practices for maximizing the benefits while minimizing the risks. Stay tuned to discover how you can leverage Pendle Finance for your DeFi journey.

Stake Your Crypto with High APYs & Earn Passively >>

VI. Conclusion

A. Recap of Pendle Finance's key features and benefits

Pendle Finance is a revolutionary platform that brings increased liquidity, flexibility, and control to the world of yield markets in decentralized finance (DeFi). By tokenizing future yields into tradeable Pendle Tokens, users can unlock the value of their income streams and actively participate in a diverse range of yield-generating opportunities. The platform offers enhanced liquidity, the ability to trade future yields, and the potential for additional rewards through yield farming.

B. Emphasis on the potential of Pendle Finance for optimizing yield opportunities

Pendle Finance holds immense potential for optimizing yield opportunities within the DeFi ecosystem. By leveraging the platform's features, users can strategically allocate their assets, capitalize on favorable market conditions, and maximize their overall returns. The ability to tokenize and trade future yields empowers users with greater financial flexibility, allowing them to adapt their investment strategies and explore new income streams. Pendle Finance presents a gateway to unlocking the full potential of one's assets and generating additional income.

C. Encouragement to explore Pendle Finance for users interested in DeFi

For users interested in decentralized finance and the opportunities it presents, Pendle Finance is a platform worth exploring. With its user-friendly interface, innovative features, and emphasis on liquidity and flexibility, Pendle Finance offers a compelling solution for those seeking to optimize their yield-generation strategies. It provides users with greater control over their assets and the ability to actively manage and trade their income streams.

However, it's important for users to be aware of the potential risks associated with DeFi protocols and market volatility. Proper research, risk management, and a cautious approach are essential when engaging with Pendle Finance or any other DeFi platform. Users should also stay updated with the latest developments, security best practices, and community discussions to make informed decisions and navigate the evolving DeFi landscape successfully.

In conclusion, Pendle Finance opens up new possibilities for users to enhance their yield generation, unlock the value of future income streams, and take control of their financial assets. By harnessing the platform's features, users can optimize their investment strategies, capitalize on yield opportunities, and potentially achieve higher returns. For those interested in DeFi, exploring Pendle Finance can be a valuable step towards realizing the full potential of their assets in the decentralized finance ecosystem.

Related Articles:

- 1inch Staking: High-Yield Rewards on the Best Staking Platform

- CakeDeFi: The Best DeFi Staking Platform for Financial Growth

- PrimexBT Copy Trading: The Best Crypto Copy Trading Platform? A Comprehensive Review

- StormGain Mining Review: A Complete Guide to Cryptocurrency Mining with StormGain

- 3 Trusted Cloud Mining Sites to Start Mining Crypto Today in 2023

- How to Maximize Your Crypto Investments with 3commas DCA Bot

- How to win free cryptocurrency?

0 Comments

Post a Comment