Welcome to the world of Polymath Crypto, a groundbreaking platform that is reshaping the landscape of security token issuance and trading. In this article, we will explore the unique features, benefits, and potential impact of Polymath Crypto. As a leading player in the digital securities market, Polymath Crypto offers streamlined security token issuance, compliance with existing regulations, increased liquidity, and the potential for fractional ownership. By harnessing the power of blockchain technology, Polymath Crypto is revolutionizing the way businesses raise capital and investors access investment opportunities. Join us as we delve into the transformative potential of Polymath Crypto and its role in shaping the future of finance.

I. Introduction

A. Brief explanation of Polymath Crypto

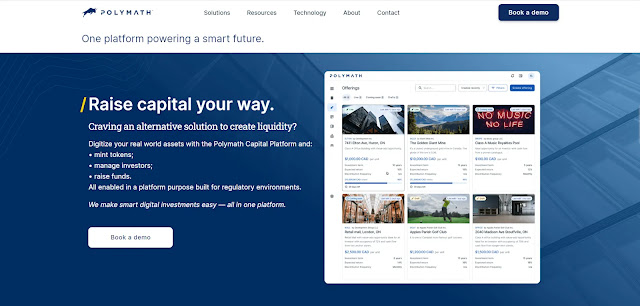

Polymath Crypto is a groundbreaking project in the world of cryptocurrencies that is revolutionizing the way security tokens are issued and traded. Built on the principles of blockchain technology, Polymath aims to bring compliance and regulatory standards to the realm of digital assets, providing a platform for the creation and management of security tokens.

Unlike utility tokens or cryptocurrencies such as Bitcoin and Ethereum, security tokens represent ownership in a traditional asset, such as equity in a company, real estate, or debt instruments. By tokenizing these securities, Polymath Crypto enables businesses to leverage the benefits of blockchain while ensuring compliance with existing financial regulations.

B. Importance of security token issuance and compliance

Security token issuance and compliance play a crucial role in the financial ecosystem. Traditional securities, such as stocks and bonds, are subject to strict regulations designed to protect investors. However, the process of issuing and trading these securities can be complex, time-consuming, and costly.

Polymath Crypto addresses these challenges by providing a streamlined platform for security token issuance and management. By digitizing securities and leveraging blockchain technology, Polymath simplifies the entire process, reducing costs and increasing efficiency. Moreover, it facilitates compliance with regulatory requirements, ensuring that security token offerings (STOs) are conducted within the legal framework.

The importance of security token issuance and compliance extends beyond simplifying processes. It opens up new opportunities for investors, allowing them to access a wider range of assets and participate in fractional ownership. Furthermore, it provides businesses with increased liquidity and global reach, attracting a broader investor base. Polymath Crypto serves as a catalyst for innovation, bridging the gap between traditional finance and the world of cryptocurrencies.

As the demand for security token offerings continues to grow, Polymath Crypto stands at the forefront of this transformative movement, providing a secure, compliant, and efficient platform for businesses and investors alike. In the following sections, we will delve deeper into the unique features and benefits of Polymath Crypto, shedding light on its potential impact on the financial landscape.

Earn Crypto Passively 100% FREE 😁 >>

II. Unique Features of Polymath Crypto

A. Tokenization of securities

One of the key features that set Polymath Crypto apart is its ability to tokenize securities. By tokenizing traditional assets such as stocks, bonds, and real estate, Polymath enables businesses to represent ownership digitally on the blockchain. This process converts the assets into security tokens, which can be easily traded and transferred.

Tokenization brings numerous advantages to the world of finance. Firstly, it increases accessibility and liquidity. Previously illiquid assets can now be divided into smaller, tradable fractions, allowing a wider range of investors to participate. Tokenization also streamlines the transfer of ownership, reducing administrative complexities and associated costs.

B. Regulatory compliance and legal framework

Polymath Crypto places a strong emphasis on regulatory compliance, offering a comprehensive legal framework for security token issuance. By incorporating compliance measures into the platform, Polymath ensures that security token offerings adhere to existing financial regulations, providing investors with a higher level of protection.

The platform includes features such as Know Your Customer (KYC) procedures and accredited investor verification, which verify the identities and qualifications of participants. This focus on compliance not only increases investor confidence but also paves the way for institutional investors to enter the space, further enhancing liquidity and market stability.

C. Simplified issuance process

Polymath Crypto simplifies the process of issuing security tokens by providing a user-friendly platform and intuitive tools. Companies can create and customize their security token offerings according to their specific requirements. The platform guides businesses through the issuance process, ensuring compliance with regulatory standards and reducing the complexities associated with traditional securities issuance.

The streamlined issuance process offered by Polymath saves time and costs for businesses, making it easier for them to tap into the benefits of tokenization. Moreover, the platform enables efficient investor onboarding, allowing investors to participate in security token offerings with ease.

D. Increased liquidity and fractional ownership

Through the tokenization of securities, Polymath Crypto unlocks the potential for increased liquidity and fractional ownership. By dividing assets into smaller units, investors can purchase fractions of security tokens, making investment opportunities accessible to a broader range of individuals. This fractional ownership model also provides flexibility, as investors can buy and sell their shares more easily, increasing market liquidity.

The ability to trade fractional security tokens introduces new avenues for investment diversification, empowering investors to create portfolios that align with their preferences and risk tolerance. Additionally, fractional ownership broadens access to traditionally exclusive assets, such as high-value real estate or private equity, fostering financial inclusion.

E. Peer-to-peer trading

Polymath Crypto facilitates peer-to-peer trading of security tokens through its platform. By removing the need for intermediaries, such as brokers or exchanges, the platform enables direct transactions between buyers and sellers. This peer-to-peer trading model enhances efficiency, reduces costs, and eliminates unnecessary delays in the trading process.

With peer-to-peer trading, investors have greater control over their transactions, allowing for faster execution and increased transparency. Furthermore, it fosters a global marketplace, as participants from different geographical locations can engage in trading without the limitations imposed by traditional financial systems.

In the next section, we will explore the benefits that Polymath Crypto brings to the table, highlighting the advantages for businesses and investors looking to leverage security tokenization in the digital age.

III. Benefits of Polymath Crypto

A. Enhanced accessibility and global reach

Polymath Crypto offers enhanced accessibility to investment opportunities by leveraging the power of blockchain technology. Through tokenization, traditional assets become more divisible and tradable, allowing a wider range of investors to participate. This increased accessibility opens up investment avenues that were previously restricted to a select few.

Moreover, Polymath's platform facilitates global reach. Operating on a decentralized network, it eliminates geographical barriers and enables investors from different parts of the world to engage in security token offerings. This global reach fosters diversity, expands investment options, and promotes a more inclusive financial ecosystem.

B. Cost efficiency and reduced intermediaries

One of the significant advantages of Polymath Crypto is its potential for cost efficiency. By leveraging blockchain technology, the platform eliminates the need for intermediaries that are traditionally involved in securities transactions. This reduction in intermediaries not only streamlines the process but also leads to cost savings.

With fewer intermediaries, businesses can save on fees associated with brokerage services, custodial services, and other administrative costs. Investors, too, benefit from lower transaction fees and reduced dependence on middlemen. The cost-efficient nature of Polymath Crypto makes security token issuance and trading more accessible to businesses of all sizes, including startups and SMEs.

C. Transparency and immutability through blockchain technology

Blockchain technology lies at the core of Polymath Crypto, bringing transparency and immutability to security token transactions. Each transaction recorded on the blockchain is transparent and can be verified by participants, enhancing trust and reducing the risk of fraud.

Furthermore, the immutability of blockchain ensures that once a transaction is recorded, it cannot be altered or tampered with. This feature provides an added layer of security and ensures the integrity of the transaction history. Investors can have confidence in the accuracy and reliability of the information associated with security tokens, enhancing the overall trust in the ecosystem.

D. Potential for new investment opportunities

Polymath Crypto unlocks new investment opportunities by expanding the range of assets that can be tokenized. Traditionally illiquid assets, such as real estate, private equity, or venture capital, can now be tokenized and made more accessible to a broader investor base. This diversification potential allows investors to allocate their portfolios across different asset classes, mitigating risks and exploring new avenues for growth.

Moreover, the tokenization of assets opens up fractional ownership, enabling investors to buy and sell smaller fractions of high-value assets. This fractional ownership model reduces the barriers to entry and allows for greater flexibility in investment strategies. Investors can customize their portfolios, tailoring them to their preferences and risk tolerance.

E. Empowering smaller businesses and investors

Polymath Crypto levels the playing field by empowering smaller businesses and investors. The platform enables startups and SMEs to access capital by issuing security tokens, providing them with an alternative fundraising mechanism. This democratization of fundraising allows businesses to bypass traditional hurdles and tap into a larger pool of potential investors.

Similarly, smaller investors can participate in security token offerings, previously reserved for institutional investors or high-net-worth individuals. The fractional ownership model enables smaller investors to diversify their portfolios, access exclusive assets, and potentially benefit from the growth of the digital securities market.

In the subsequent section, we will explore the pros and cons of Polymath Crypto, providing a balanced perspective on the platform's strengths and limitations.

IV. Pros of Polymath Crypto

A. Streamlined security token issuance

One of the significant advantages of Polymath Crypto is its streamlined process for security token issuance. The platform offers user-friendly tools and templates that simplify the creation and customization of security token offerings. By removing the complexities associated with traditional securities issuance, Polymath Crypto enables businesses to efficiently raise capital and leverage the benefits of tokenization. This streamlined issuance process saves time and reduces costs, making it an attractive option for businesses seeking to access the digital securities market.

B. Compliance with existing regulations

Polymath Crypto places a strong emphasis on regulatory compliance, ensuring that security token offerings (STOs) adhere to existing financial regulations. By incorporating compliance measures into its platform, Polymath provides businesses and investors with a higher level of protection. Features such as Know Your Customer (KYC) procedures and accredited investor verification help verify the identities and qualifications of participants, enhancing investor confidence. This compliance-focused approach not only ensures legal compliance but also opens the doors to institutional investors, contributing to market stability and liquidity.

C. Increased liquidity and tradability

By tokenizing traditional assets, Polymath Crypto enhances liquidity and tradability in the digital securities market. The fractional ownership model introduced by security tokens allows investors to purchase smaller fractions of high-value assets, increasing market accessibility. This fractional ownership brings liquidity to traditionally illiquid assets such as real estate or private equity, as investors can easily buy and sell their fractions of security tokens. Furthermore, the peer-to-peer trading facilitated by Polymath Crypto's platform eliminates intermediaries, enabling direct transactions between buyers and sellers. This direct trading model enhances efficiency, reduces costs, and promotes a more liquid marketplace.

D. Potential for fractional ownership

Polymath Crypto unlocks the potential for fractional ownership, allowing investors to purchase smaller fractions of security tokens representing traditional assets. This fractional ownership model opens up investment opportunities to a broader range of individuals, including those with limited capital. Investors can diversify their portfolios by investing in fractions of high-value assets that were previously out of reach. Fractional ownership also offers flexibility, as investors can easily buy and sell their fractions, providing liquidity and enabling portfolio adjustments according to their investment goals.

E. Harnessing the power of blockchain technology

Polymath Crypto harnesses the power of blockchain technology to revolutionize the security token ecosystem. Blockchain provides transparency and immutability to transactions, ensuring a secure and trustworthy environment for investors and businesses. Each transaction recorded on the blockchain is transparent and can be verified, promoting trust and reducing the risk of fraud. Additionally, the immutability of blockchain ensures that once a transaction is recorded, it cannot be altered, enhancing the integrity of the digital securities market. By leveraging blockchain technology, Polymath Crypto introduces a new era of efficiency, transparency, and trust in the world of security token issuance and trading.

In the following section, we will explore the cons or potential challenges associated with Polymath Crypto, providing a balanced view of the platform.

V. Cons of Polymath Crypto

A. Evolving regulatory landscape

One of the challenges facing Polymath Crypto and the broader security token ecosystem is the evolving regulatory landscape. As cryptocurrencies and digital securities gain prominence, regulatory authorities worldwide are grappling with how to effectively regulate and oversee these emerging markets. The lack of standardized regulations and varying approaches by different jurisdictions can create uncertainties and complexities for businesses and investors operating within the Polymath ecosystem. It is essential for participants to stay updated with the evolving regulatory requirements to ensure compliance and mitigate potential risks.

B. Limited adoption and awareness

Despite the promising potential of security tokenization and platforms like Polymath Crypto, the adoption and awareness of these technologies are still relatively limited. Many businesses and investors are not yet familiar with the concept of security tokens or the benefits they offer. This lack of awareness can hinder the widespread adoption of Polymath Crypto and its platform. It is crucial for the industry to continue educating and raising awareness about the advantages of security tokens, their compliance benefits, and the value proposition of platforms like Polymath.

C. Potential risks and security concerns

While blockchain technology provides inherent security features, there are still potential risks and security concerns associated with the digital securities market and platforms like Polymath Crypto. Cybersecurity threats, such as hacking attempts or vulnerabilities in smart contracts, can pose risks to the integrity and security of the platform. It is essential for businesses and investors to implement robust security measures, conduct thorough due diligence, and stay vigilant against potential threats.

D. Volatility of the cryptocurrency market

Polymath Crypto operates within the broader cryptocurrency market, which is known for its volatility. The value of cryptocurrencies can experience significant fluctuations, which may impact the pricing and valuation of security tokens traded on the platform. Investors should be aware of the potential risks associated with market volatility and carefully consider their risk tolerance and investment strategies.

E. Dependency on external factors

The success and growth of Polymath Crypto are dependent on various external factors, including regulatory developments, market conditions, and investor sentiment. Changes in regulations, shifts in investor preferences, or economic factors can impact the adoption and utilization of the platform. Businesses and investors involved in the Polymath ecosystem should consider these external factors and adjust their strategies accordingly.

While Polymath Crypto offers numerous benefits and transformative potential, it is important for participants to be aware of the potential challenges and risks associated with the platform. By understanding these cons, businesses, and investors can make informed decisions and navigate the evolving landscape of digital securities effectively.

In the concluding section, we will summarize the key points discussed throughout the article, emphasizing the unique features, benefits, and potential impact of Polymath Crypto in the world of security token issuance and trading.

Click Here to find out the Faucets >>

VI. Conclusion

A. Recap of Polymath Crypto's unique features and benefits

Polymath Crypto has emerged as a pioneering platform in the world of security token issuance and trading. Its unique features have revolutionized the way businesses raise capital and investors access investment opportunities. By tokenizing traditional assets, Polymath facilitates increased liquidity, fractional ownership, and peer-to-peer trading. The streamlined issuance process and compliance with existing regulations further enhance the platform's appeal. Polymath Crypto harnesses the power of blockchain technology to provide transparency, immutability, and efficiency in the digital securities market.

B. Potential impact on the future of finance

Polymath Crypto's potential impact on the future of finance cannot be overstated. The platform introduces a new era of accessibility and global reach, enabling businesses and investors to participate in security token offerings from anywhere in the world. The cost efficiency and reduced intermediaries offered by Polymath Crypto can democratize the fundraising process for startups and SMEs, empowering smaller businesses to access capital and foster innovation. The fractional ownership model and increased market liquidity open up new investment opportunities and diversification potential for investors. Polymath Crypto's adherence to compliance standards paves the way for institutional investors to enter the digital securities market, further enhancing liquidity and stability.

C. Encouragement for further research and due diligence

While Polymath Crypto presents exciting prospects, it is crucial for businesses and investors to conduct thorough research and exercise due diligence. The evolving regulatory landscape, limited adoption and awareness, potential risks, and market volatility should be carefully considered. Staying informed about regulatory developments, market conditions, and best practices in cybersecurity will help participants navigate the digital securities market effectively. Engaging with experts and seeking professional advice can provide valuable insights and mitigate potential risks.

As the world of finance continues to embrace digital transformation, Polymath Crypto stands at the forefront, offering a secure, compliant, and efficient platform for security token issuance and trading. Its unique features and benefits have the potential to reshape the landscape of traditional securities and open up new horizons for businesses and investors. By embracing the possibilities offered by Polymath Crypto and staying informed about the evolving ecosystem, participants can position themselves at the forefront of this exciting revolution in finance.

Remember, further research and due diligence are essential to fully grasp the nuances and implications of Polymath Crypto and the evolving world of security tokens. Stay informed, explore the potential, and seize the opportunities that this transformative technology brings.

DISCLAIMER: The information provided in this article is for educational and informational purposes only and should not be considered financial or investment advice.

Related Articles:

- Sygnum Bank - Empowering Your Digital Asset Journey

- ChangeNOW Exchange - Swapping Cryptocurrencies Made Simple

- Power of Gunbot - Guide to Creating Trading Bots and Automated Trading Strategies

- Maximizing Trading Profits with Eightcap | Automated Trading Strategies

- PrimexBT Copy Trading: The Best Crypto Copy Trading Platform? A Comprehensive Review

- How to Boost Your Crypto Trading with Bitget Copy Trading

0 Comments

Post a Comment