I. Introduction

A. Explanation of the importance of accurate crypto tax reporting

As the popularity of cryptocurrency grows, so does the need for accurate tax reporting. The IRS requires all individuals and businesses to report their cryptocurrency transactions on their tax returns, just like any other investment. Failing to report these transactions accurately can result in penalties, fines, or even legal action. Accurate tax reporting is crucial to avoid these consequences and ensure compliance with tax laws.

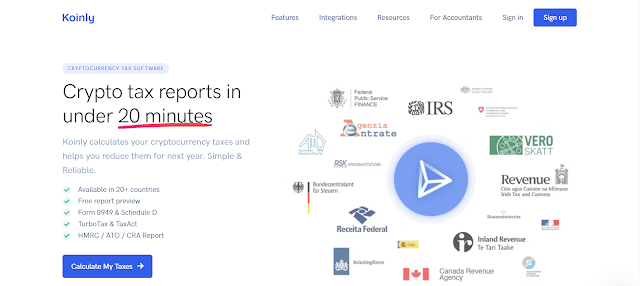

B. Introduction to Koinly Tax as a solution

Koinly Tax is a user-friendly software solution that simplifies the process of crypto tax reporting. With Koinly Tax, individuals and businesses can easily import their cryptocurrency transactions from exchanges, wallets, and other sources. The software then automatically generates accurate tax reports in a matter of minutes, saving time and reducing the risk of errors.

C. Brief overview of what the article will cover

This article will explore the challenges of crypto tax reporting, and how Koinly Tax provides a solution to these challenges. We'll discuss the benefits of using Koinly Tax for crypto tax reporting, and provide a step-by-step guide on how to sign up and use the software. By the end of this article, you'll understand why Koinly Tax is the best solution for accurate and hassle-free crypto tax reporting.

Visit Koinly Official Website >>

II. The Challenges of Crypto Tax Reporting

A. Explanation of the complex nature of crypto taxes

Crypto taxes are notoriously complex and confusing. Unlike traditional investments, cryptocurrency is not regulated by a central authority, making it difficult to determine how it should be taxed. In addition, there are a variety of tax implications based on the specific type of cryptocurrency transaction, such as mining, staking, and trading. Keeping track of all of these transactions and understanding the tax implications can be overwhelming for individuals and businesses alike.

B. Discussion of common mistakes made by individuals when reporting taxes on crypto investments

Due to the complexity of crypto taxes, it's easy for individuals to make mistakes when reporting their crypto investments on their tax returns. Some common mistakes include failing to report all crypto transactions, miscalculating gains and losses, and failing to report crypto held in foreign exchanges or wallets. These mistakes can result in penalties, fines, or even legal action, making accurate tax reporting essential for individuals and businesses involved in crypto investments. In the next section, we'll explore how Koinly Tax simplifies the process of crypto tax reporting, reducing the risk of errors and ensuring compliance with tax laws.

Calculate Your Crypto Tax in One Click with Koinly - Say Goodbye to Hassles! >>

III. How Koinly Tax Simplifies Tax Reporting

A. Explanation of the features of Koinly Tax

Koinly Tax is a software solution that simplifies the process of crypto tax reporting. Some of its key features include support for over 6,000 cryptocurrencies, integration with over 300 exchanges and wallets, and the ability to generate tax reports for multiple countries. Koinly Tax also provides users with a real-time overview of their crypto portfolio, making it easy to keep track of gains and losses.

B. Discussion of how the software automates the tax reporting process and reduces the risk of errors

Koinly Tax automates the tax reporting process, reducing the risk of errors and saving users time. The software uses sophisticated algorithms to calculate gains and losses and generate tax reports, eliminating the need for manual calculations. Koinly Tax also automatically detects and flags potential errors, such as missing transactions or incorrect cost basis data, reducing the risk of mistakes.

C. Description of how Koinly Tax ensures accuracy and maximizes savings

Koinly Tax ensures accuracy and maximizes savings by providing users with a comprehensive view of their crypto portfolio and tax liability. The software calculates taxes based on specific country tax laws, ensuring compliance with local tax regulations. Koinly Tax also provides users with a range of tax optimization tools, such as tax-loss harvesting and like-kind exchange reporting, to help maximize savings. By simplifying the tax reporting process and providing users with accurate and reliable tax reports, Koinly Tax helps individuals and businesses save time and money come tax season.

Start For Free and Save Hours with Koinly! >>

IV. The Benefits of Using Koinly Tax

A. Discussion of the advantages of using Koinly Tax for crypto tax reporting

Using Koinly Tax for crypto tax reporting offers a number of advantages over traditional methods. One of the biggest advantages is the software's ability to support a wide range of cryptocurrencies and exchanges, making it easy for users to track their entire crypto portfolio in one place. Koinly Tax also automates the tax reporting process, saving users time and reducing the risk of errors. Additionally, Koinly Tax provides users with detailed tax reports that are compliant with local tax regulations, helping to minimize the risk of audits and penalties.

B. Examples of how Koinly Tax has helped individuals and businesses save time and money

Koinly Tax has helped many individuals and businesses save time and money on their crypto tax reporting. For example, a cryptocurrency trader who previously spent hours manually calculating gains and losses was able to use Koinly Tax to automate the process and generate accurate tax reports in just a few minutes. Similarly, a small business owner who had been struggling to keep track of their crypto transactions was able to use Koinly Tax to easily generate tax reports for their accountant, saving them both time and money.

C. Comparison to other tax reporting options

Compared to other tax reporting options, Koinly Tax offers a number of advantages. Traditional tax reporting methods, such as manual calculations or spreadsheets, are time-consuming and prone to errors. Other software solutions may not offer the same level of support for a wide range of cryptocurrencies or exchanges. Koinly Tax, on the other hand, offers a comprehensive solution that automates the tax reporting process and ensures compliance with local tax regulations. Additionally, Koinly Tax provides users with a real-time overview of their crypto portfolio and offers a range of tax optimization tools to help maximize savings.

Click Here & SignUp For Free >>

V. How to Sign Up for Koinly Tax

A. Step-by-step guide on how to sign up for Koinly Tax

Signing up for Koinly Tax is a straightforward process that can be completed in just a few minutes. Here's a step-by-step guide to get started:

- Visit the Koinly Tax website and click on the "Sign Up" button in the top right corner.

- Choose a plan that best suits your needs based on the number of transactions you need to track. Koinly Tax offers several pricing options to fit various budgets and crypto portfolios.

- Create an account by entering your name, email address, and secure password.

- Once you've created your account, you'll be prompted to add your exchanges and wallets. Koinly Tax supports over 600 exchanges and wallets, so chances are your crypto investments are covered.

- Sync your transactions by connecting your exchanges and wallets to Koinly Tax. This will allow the software to automatically import your transactions and generate accurate tax reports.

B. Explanation of pricing options and how they compare to other tax reporting services

Koinly Tax offers several pricing options to fit a range of budgets and crypto portfolios. The plans start at $49 per year for up to 100 transactions and go up to $379 per year for up to 10,000 transactions (The pricing may vary based on market trends and seasonality). Compared to other tax reporting services, Koinly Tax is competitively priced and offers more comprehensive features. Additionally, Koinly Tax offers a free trial period that allows users to try the software before committing to a plan.

C. Overview of the Koinly Tax dashboard and how to use it to track investments and generate tax reports

The Koinly Tax dashboard provides users with a real-time overview of their crypto portfolio and allows them to track investments and generate tax reports with ease. The dashboard is user-friendly and provides a range of features, including transaction history, current holdings, and performance tracking. Users can also generate tax reports with just a few clicks, making tax reporting a breeze. The reports are customizable and provide a detailed breakdown of gains and losses, making it easy for users to file their taxes accurately and efficiently.

Sign up for Koinly now to simplify your crypto tax reporting and maximize your savings! >>

VI. Conclusion

In conclusion, accurate tax reporting is crucial for crypto investors and businesses. The complex nature of crypto taxes can be challenging to navigate, but with the right tools and resources, it can be simplified. Koinly Tax is a powerful software solution that automates the tax reporting process, reduces the risk of errors, and maximizes savings.

Using Koinly Tax has many benefits, including saving time and money, ensuring accuracy, and providing easy-to-use tools for tracking investments and generating tax reports. While there are other tax reporting options available, Koinly Tax stands out with its comprehensive features, intuitive user interface, and competitive pricing options.

Signing up for Koinly Tax is simple and straightforward, with a step-by-step guide available to help users through the process. With different pricing options available, users can choose the plan that best fits their needs and budget. The Koinly Tax dashboard is easy to navigate, and users can track their investments and generate tax reports with just a few clicks.

In conclusion, Koinly Tax is an excellent option for anyone looking to simplify their crypto tax reporting process, save time and money, and ensure accuracy. With its powerful features and user-friendly interface, Koinly Tax makes crypto tax reporting a breeze.

Related Articles:

- How to Report Cryptocurrency on Taxes

- Top Crypto Tax Platforms for Hassle-Free Tax Filing

- Say Goodbye to Hacking and Theft with the Unbeatable Ledger Nano Hardware Wallet

- How to win free cryptocurrency?

- Safepal Hardware Wallet Review: The Best Way to Secure Your Crypto Assets

- Secure Your Crypto Assets with the Best Crypto Hardware Wallets

0 Comments

Post a Comment